Limitless Case Study: Prediction Markets

Prediction markets are emerging as a new craze in decentralized finance, gaining significant attention and establishing themselves as major players in this cycle's narrative. The upcoming US election is driving this interest, raising questions about the sustainability of trading volume after the election. Others strongly believe that prediction markets have found product-market fit, capturing mainstream attention and joining other established categories like stablecoins, NFTs, meme coins, and lending and borrowing protocols.

This new paradigm of prediction markets leverages blockchain technology and cryptocurrency as infrastructure, offering better user experiences than what existed before. Low fees, global accessibility, permissionless operation, and ease of coordination contribute to their adoption and success. Built on a public blockchain, these platforms ensure that all transactions are transparent, censorship-resistant, and executed quickly and accurately by smart contracts.

Prediction markets are evolving into a new form of media — a source of truth, a peer-to-peer social platform, and an engagement mechanism that incentivizes correctness (or as close to correctness as possible, given the information available).

What is a Prediction Market?

Prediction markets allow participants to buy and sell shares based on the outcome of future events, such as crypto prices, sporting events, or political elections. In decentralized finance, these markets operate transparently using smart contracts to ensure trustless participation and automatic settlement. By leveraging crowd wisdom, prediction markets provide a collective forecast of future events, allowing users to earn rewards based on accurate predictions.

How do Prediction Markets work?

Prediction markets rely on smart contracts and oracles to function securely and transparently. Smart contracts are self-executing programs on the blockchain that automate the trading process, manage payouts, and ensure trustless execution. Oracles serve as bridges between the blockchain and the real world by providing accurate, tamper-resistant data regarding the outcome of events.

Prediction markets allow you to bet on whether an event will occur, with financial rewards for correct predictions. You can buy shares in an event's outcome, and if the event happens, you can redeem your shares for a profit.

When the event's outcome is determined, the oracle sends the information to the smart contract, which then automatically distributes the rewards to participants based on their positions. This combination of blockchain technology ensures that prediction markets are decentralized, secure, and resistant to manipulation.

Overview of Prediction Markets

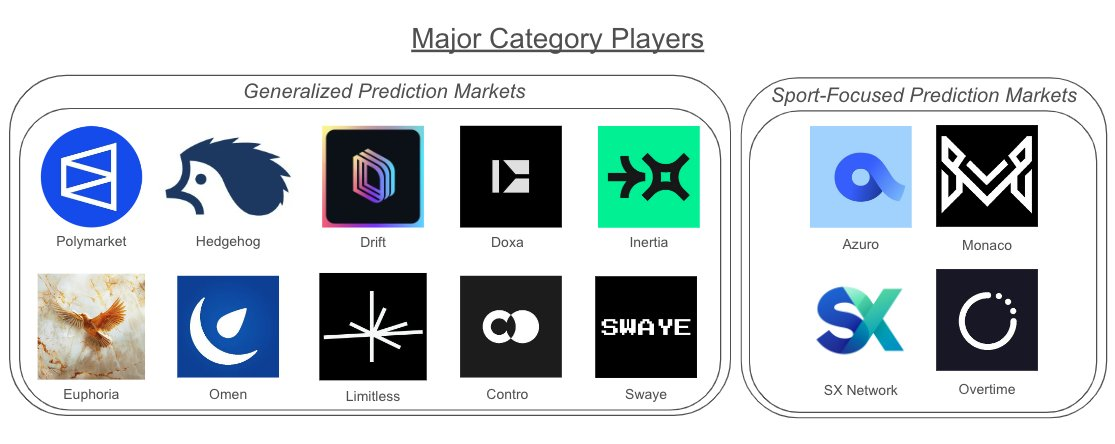

Currently, Polymarket is the world's largest prediction market. Deployed on Polygon, Polymarket has experienced exponential growth, with elections accounting for 85% of its total volume. In July 2024, the platform generated an impressive $137.3 million in weekly trading volume. Data also suggests that non-election prediction markets have been increasing, such as betting on crypto prices, sports results, or social events.

Azuro Protocol stands out for its sports betting markets, which provide the tooling, oracle, and liquidity solution for EVM chains to host sports-specific prediction markets. B.E.T. built on top of the Drift Protocol, and Hedgehog, are two popular prediction markets on Solana, with B.E.T. recently reaching $20 million daily volume.

Limitless Exchange, a new daily prediction market on Base focusing on price action and sporting events, recently hit over $9.7 million in volume. A week prior, Limitless was doing $100k in volume, suggesting its traction is growing.

Each prediction market platform aims to be capital-efficient and use different mechanisms to incentivize engagement and accuracy, integrating underlying DeFi capabilities. Some of these include, but are not limited to:

- Earning yield on your positions, integrating yield through lending/borrowing platforms

- Hedging positions, by going long on a prediction market while simultaneously shorting a cryptocurrency, such as Bitcoin.

- Utilizing different tokens as collateral, not just stablecoins. Limitless allows the use of USDC, ETH, BTC as well as any - ERC-20-compliant token.

- DAO structures and governance models allow participants to stake tokens on the underlying platform token and vote in determining future markets

What is Limitless Exchange?

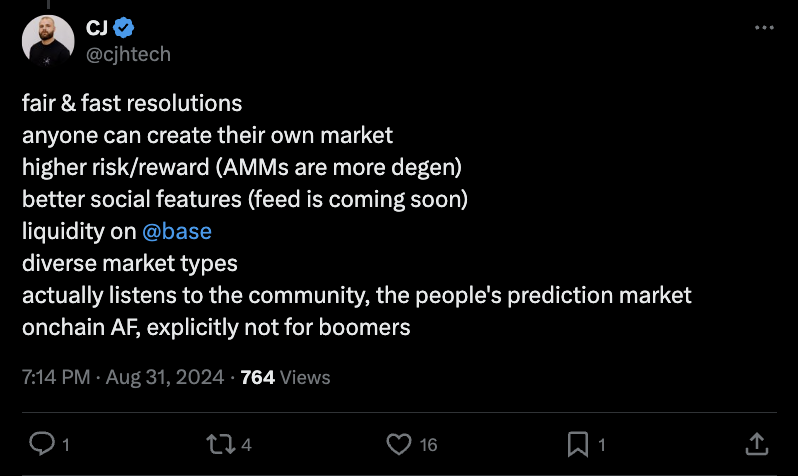

Envio has had the pleasure of working closely with the team behind Limitless Exchange, a daily prediction market built on Base and coined as the “people's prediction market.”

With Limitless Exchange, participants can use various tokens, take part in transparent voting for upcoming markets, and engage in opportunities created by the community. The platform promotes community involvement, allowing users to configure their own markets and share them with others.

Limitless Exchange leverages AI-driven data analytics to provide real-time insights, empowering users to make informed predictions based on the latest information. The platform supports a wide range of prediction scenarios, enhancing the overall user experience with timely and accurate data.

How Envio powers Limitless’s Daily Prediction Markets

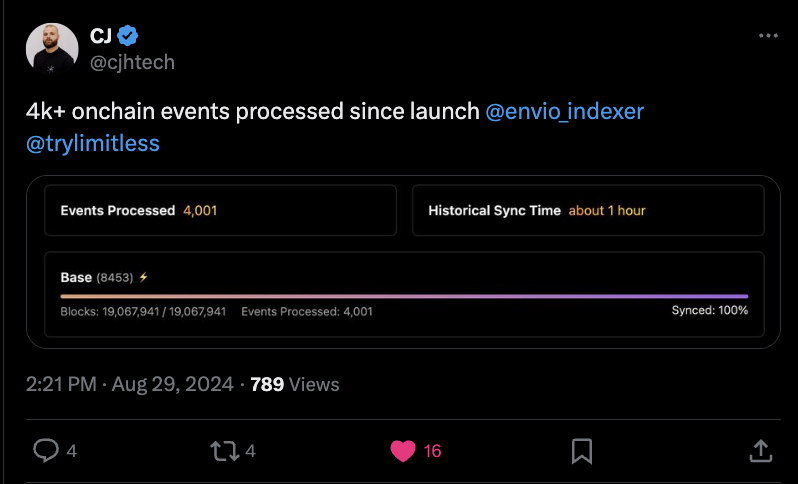

While smart contracts and oracles are core infrastructure components that enable decentralized prediction markets to function securely and autonomously, another essential mission-critical infrastructure component in blockchain applications is the ability to deliver real-time updates to users, ensuring a frictionless experience. With ambitious growth objectives and a commitment to a seamless user experience, the Limitless Exchange team recognized the need to optimize its data infrastructure early on to support its expanding range of prediction markets and growth strategy.

To achieve this, Limitless Exchange selected Envio as its data indexer and accelerated data infrastructure partner. Envio provides real-time data query capabilities and blazing-fast indexing of onchain data, allowing Limitless to query its onchain data efficiently through a custom application GraphQL API.

The introduction of new features—such as customizable markets, enhanced reward systems, and a transaction feed, all of which operate on-chain—requires a robust solution for handling and querying this data efficiently. Envio's feature-rich data indexing framework enables protocols like Limitless Exchange to create application-tailored APIs with ease.

Limitless Exchange is able to query information such as:

- New prediction markets and their associated contract addresses, collateral tokens, launch dates, and expiry dates

- Volume traded per market, volume per participant, total volume traded

- Price feed from Oracles as resolution source

- Winning shares and ROI for market participants

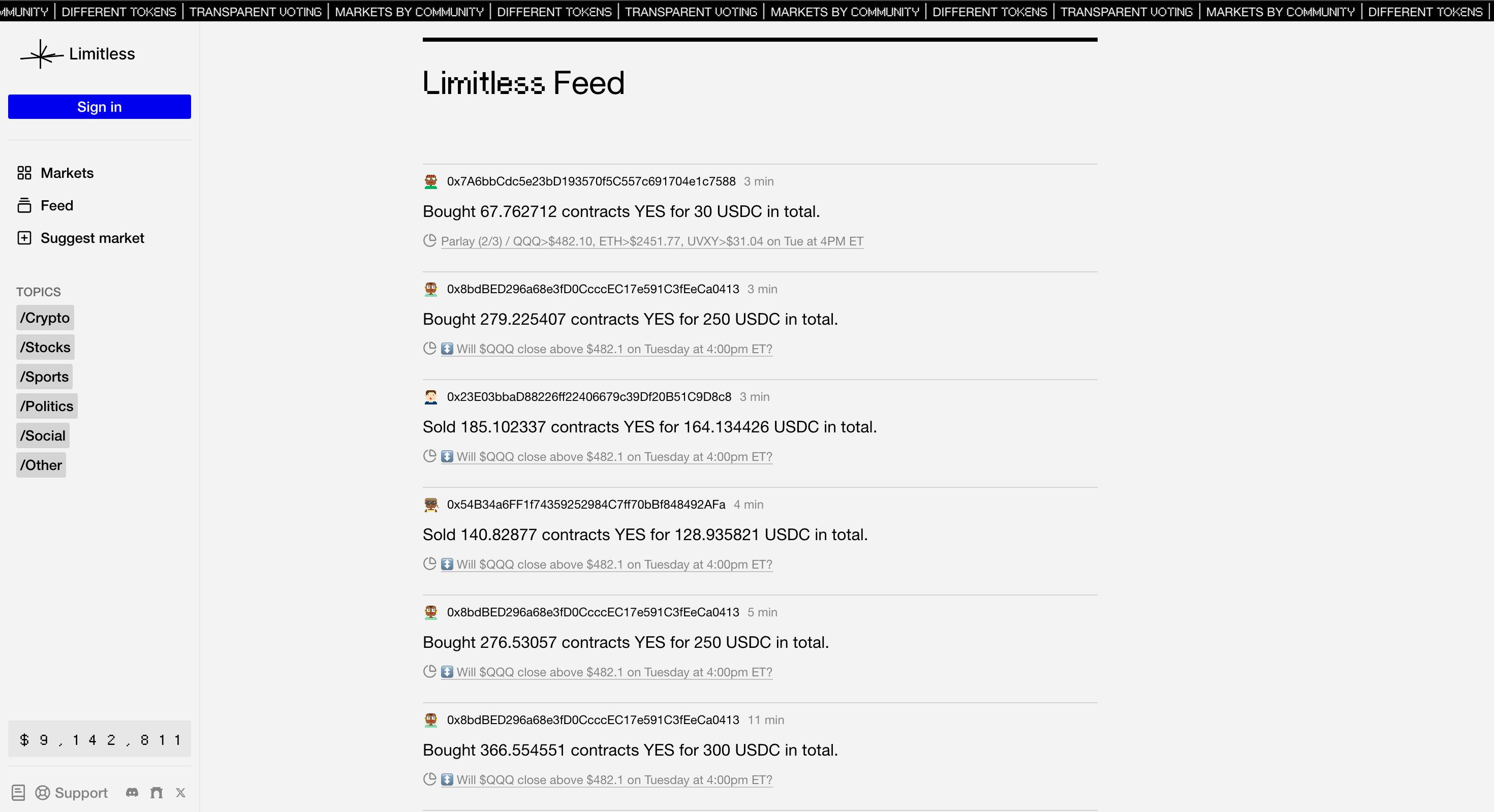

- Transaction History, such as “Limitless Feed”

Screenshot of https://limitless.exchange/ new transaction feed, powered by Envio.

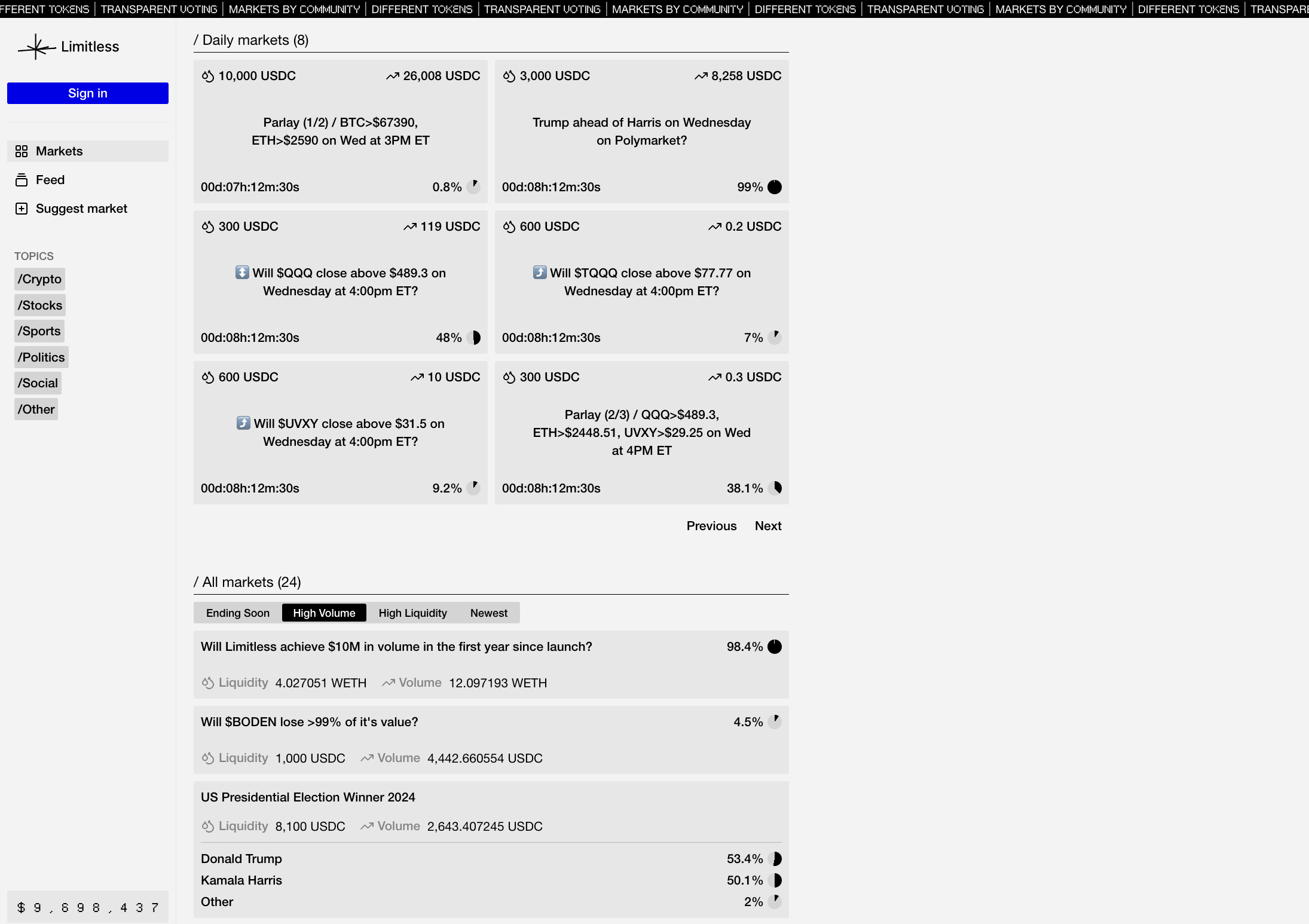

Screenshot of https://limitless.exchange/ markets overview, powered by Envio.

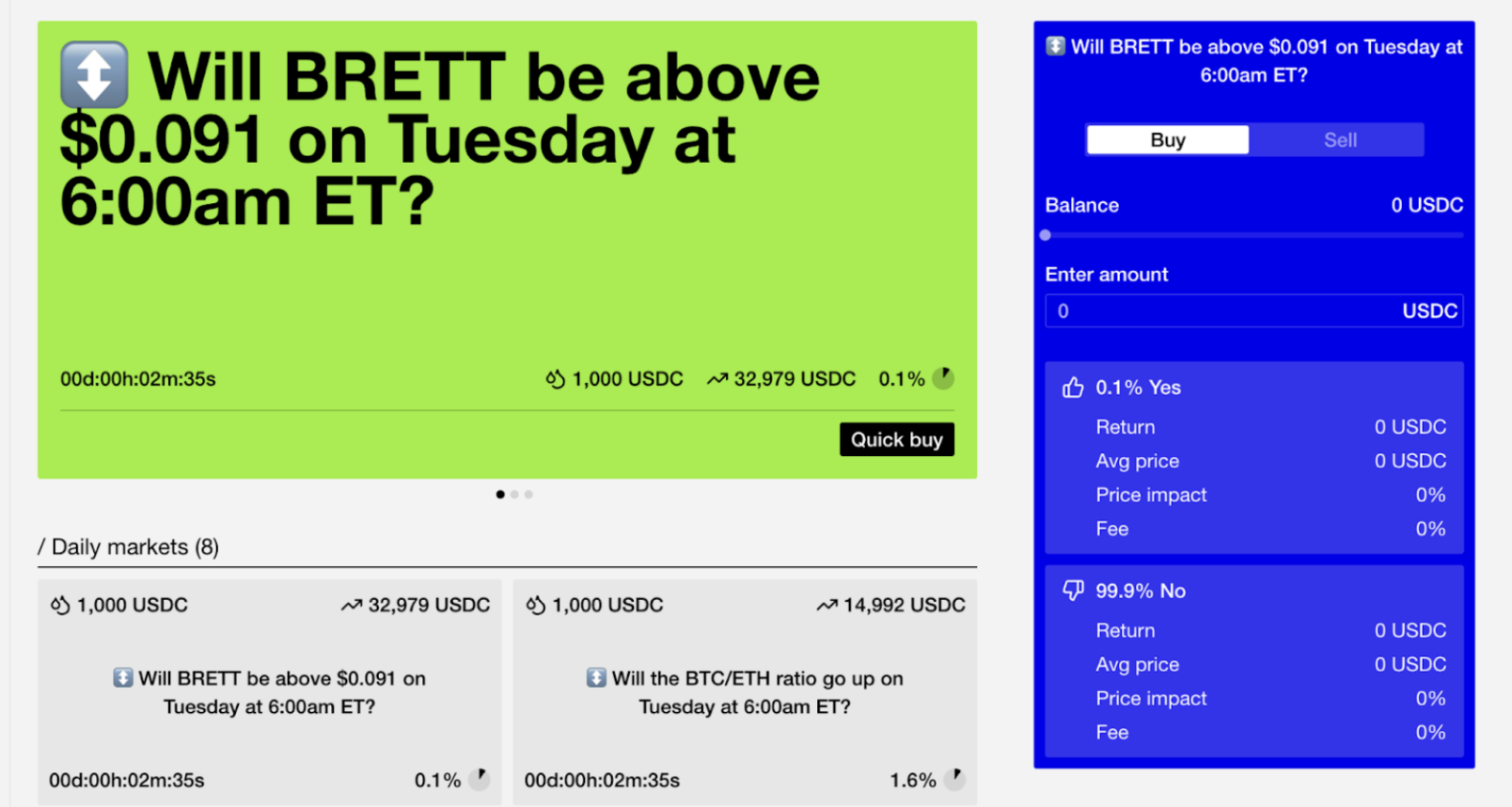

A screenshot of https://limitless.exchange/ quick bets, powered by Envio.

The Limitless Exchange Indexer and other indexers can be viewed in the Explorer of Envio’s Hosted Service.

Other Envio Indexers related to Prediction Markets

The Azuro Indexer code can be seen here.

Relevant Links

Conclusion

As Limitless Exchange continues to grow and innovate, our collaboration remains a cornerstone of their strategy. We look forward to seeing how this integration will enhance their mission and drive new developments in the prediction market space.

Prediction markets still have untapped potential, especially in Web3. While they may lose steam post-election, the innovation around social layers, permissionless markets, and AI-driven insights is setting them up for a major resurgence. Prediction markets could evolve into a mainstream tool for decision-making, gaining both users and legitimacy.

About Envio

Envio is a fast, developer friendly blockchain indexer and the fastest, most flexible way to get on-chain data, making real-time data accessible for developers across the Web3 ecosystem.

With Envio, developers can query and stream blockchain data efficiently without the complexity of running their own infrastructure. Envio’s blockchain indexing tools supports any EVM network and is trusted by many teams building everything from DeFi platforms to analytics dashboards and production applications.

If you’re a blockchain developer or analyst looking to enhance your workflow, look no further. Join our growing community of Web3 builders and explore our docs.