Getting Price Data in Your Indexer

Introduction

Many blockchain applications require price data to calculate values such as:

- Historical token transfer values in USD

- Total value locked (TVL) in DeFi protocols over time

- Portfolio valuations at specific points in time

This tutorial explores three different approaches to incorporating price data into your Envio indexer, using a real-world example of tracking ETH deposits into a Uniswap V3 liquidity pool on the Blast blockchain.

TL;DR: The complete code for this tutorial is available in this GitHub repository.

What You'll Learn

In this tutorial, you'll:

- Compare three different methods for accessing token price data

- Analyze the tradeoffs between accuracy, decentralization, and performance

- Implement a multi-source price feed in an Envio indexer

- Build a practical example indexing Uniswap V3 liquidity events with price context

Price Data Methods Compared

There are three primary methods to access price data within your indexer:

| Method | Description | Speed | Accuracy | Decentralization |

|---|---|---|---|---|

| Oracles | On-chain price feeds (e.g., API3, Chainlink) | Fast | Medium | Medium |

| DEX Pools | Swap events from decentralized exchanges | Fast | Medium-High | High |

| Off-chain APIs | External services (e.g., CoinGecko) | Slow | High | Low |

Let's explore each method in detail.

Method 1: Using Oracle Price Feeds

Oracle networks provide on-chain price data through specialized smart contracts. For this tutorial, we'll use API3 price feeds on Blast.

How Oracles Work

Oracle services like API3 maintain a network of data providers that push price updates to on-chain contracts. These updates typically occur:

- At regular time intervals

- When price deviations exceed a predefined threshold (e.g., 1%)

- When manually triggered by network participants

Finding the Right Oracle Feed

To locate the ETH/USD price feed using API3 on Blast:

-

Identify the API3 contract address:

0x709944a48cAf83535e43471680fDA4905FB3920a -

Find the data feed ID for ETH/USD:

- The dAPI name "ETH/USD" as bytes32:

0x4554482f55534400000000000000000000000000000000000000000000000000 - Using the

dapiNameToDataFeedIdfunction, this maps to0x3efb3990846102448c3ee2e47d22f1e5433cd45fa56901abe7ab3ffa054f70b5

- The dAPI name "ETH/USD" as bytes32:

-

Monitor the

UpdatedBeaconSetWithBeaconsevents with this data feed ID to get price updates

Oracle Advantages and Limitations

Advantages:

- Fast indexing (no external API calls required)

- Moderate decentralization

- Generally reliable data

Limitations:

- Updates only on significant price changes

- Limited token coverage (mainly high-liquidity pairs)

- Minor accuracy tradeoffs

Method 2: Using DEX Pool Swap Events

Decentralized exchanges like Uniswap provide price data through swap events. We'll use the USDB/WETH pool on Blast to derive ETH pricing.

Locating the Right DEX Pool

First, we need to find the specific Uniswap V3 pool for USDB/WETH:

import { createPublicClient, http, parseAbi, getContract } from "viem";

import { blast } from "viem/chains";

const usdb = "0x4300000000000000000000000000000000000003";

const weth = "0x4300000000000000000000000000000000000004";

const factoryAddress = "0x792edAdE80af5fC680d96a2eD80A44247D2Cf6Fd";

const factoryAbi = parseAbi([

"function getPool( address tokenA, address tokenB, uint24 fee ) external view returns (address pool)",

]);

const providerUrl = "https://rpc.ankr.com/blast";

const poolBips = 3000; // 0.3%. This is measured in hundredths of a bip

const client = createPublicClient({

chain: blast,

transport: http(providerUrl),

});

const factoryContract = getContract({

abi: factoryAbi,

address: factoryAddress,

client: client,

});

(async () => {

const poolAddress = await factoryContract.read.getPool([

usdb,

weth,

poolBips,

]);

console.log(poolAddress);

})();

Tip: You can also manually find the pool address using the

getPoolfunction on a block explorer.

Running this code reveals the USDB/WETH pool is at 0xf52B4b69123CbcF07798AE8265642793b2E8990C.

Getting Price Data From Swap Events

Uniswap V3 emits Swap events containing price information in the sqrtPriceX96 field. To convert this to a price, we'll use a formula in our event handler.

DEX Advantages and Limitations

Advantages:

- Very decentralized

- High update frequency

- Wide token coverage

Limitations:

- Susceptible to price impact and manipulation (especially in low-liquidity pools)

- Requires extra calculations to derive prices

- May require multiple pools for cross-pair calculations

Method 3: Using Off-chain APIs

External price APIs like CoinGecko provide comprehensive token price data but require HTTP calls from your indexer.

Making API Requests

Here's a simple function to fetch historical ETH prices from CoinGecko:

const COIN_GECKO_API_KEY = process.env.COIN_GECKO_API_KEY;

async function fetchEthPriceFromUnix(

unix: number,

token = "ethereum"

): Promise<number> {

// convert unix to date dd-mm-yyyy

const _date = new Date(unix * 1000);

const date = _date.toISOString().slice(0, 10).split("-").reverse().join("-");

return fetchEthPrice(date.slice(0, 10), token);

}

async function fetchEthPrice(

date: string,

token = "ethereum"

): Promise<number> {

const options = {

method: "GET",

headers: {

accept: "application/json",

"x-cg-demo-api-key": COIN_GECKO_API_KEY,

},

};

return fetch(

`https://api.coingecko.com/api/v3/coins/${token}/history?date=${date}&localization=false`,

options as any

)

.then((res) => res.json())

.then((res: any) => {

const usdPrice = res.market_data.current_price.usd;

console.log(`ETH price on ${date}: ${usdPrice}`);

return usdPrice;

})

.catch((err) => console.error(err));

}

export default fetchEthPriceFromUnix;

Note: The free CoinGecko API only provides daily price data (at 00:00 UTC), not block-by-block precision. For production use, consider a paid API with more granular historical data.

Off-chain API Advantages and Limitations

Advantages:

- Highest accuracy (with paid APIs)

- Most comprehensive token coverage

- No susceptibility to on-chain manipulation

Limitations:

- Significantly slows indexing speed due to API calls

- Centralized data source

- May require paid subscriptions for full functionality

Building a Multi-Source Price Feed Indexer

Now let's build an indexer that compares all three methods when tracking Uniswap V3 liquidity pool deposits.

Step 1: Initialize Your Indexer

Create a new Envio indexer project:

pnpx envio init

Step 2: Configure Your Indexer

Edit your config.yaml file to track both the API3 oracle and the Uniswap V3 pool:

# yaml-language-server: $schema=./node_modules/envio/evm.schema.json

name: envio-indexer

preload_handlers: true

networks:

- id: 81457

start_block: 11000000

contracts:

- name: Api3ServerV1

address:

- 0x709944a48cAf83535e43471680fDA4905FB3920a

handler: src/EventHandlers.ts

events:

- event: UpdatedBeaconSetWithBeacons(bytes32 indexed beaconSetId, int224 value, uint32 timestamp)

- name: UniswapV3Pool

address:

- 0xf52B4b69123CbcF07798AE8265642793b2E8990C

handler: src/EventHandlers.ts

events:

- event: Swap(address indexed sender, address indexed recipient, int256 amount0, int256 amount1, uint160 sqrtPriceX96, uint128 liquidity, int24 tick)

- event: Mint(address sender, address indexed owner, int24 indexed tickLower, int24 indexed tickUpper, uint128 amount, uint256 amount0, uint256 amount1)

field_selection:

transaction_fields:

- "hash"

Important: The

field_selectionsection is needed to include transaction hashes in your indexed data.

Step 3: Define Your Schema

Create a schema that captures price data from all three sources:

type OraclePoolPrice {

id: ID!

value: BigInt!

timestamp: BigInt!

block: Int!

}

type UniswapV3PoolPrice {

id: ID!

sqrtPriceX96: BigInt!

timestamp: Int!

block: Int!

}

type EthDeposited {

id: ID!

timestamp: Int!

block: Int!

oraclePrice: Float!

poolPrice: Float!

offChainPrice: Float!

offchainOracleDiff: Float!

depositedPool: Float!

depositedOffchain: Float!

depositedOrcale: Float!

txHash: String!

}

Step 4: Implement Event Handlers

Create event handlers to process data from all three sources:

import {

Api3ServerV1,

OraclePoolPrice,

UniswapV3Pool,

UniswapV3PoolPrice,

EthDeposited,

} from "generated";

import fetchEthPriceFromUnix from "./request";

let latestOraclePrice = 0;

let latestPoolPrice = 0;

Api3ServerV1.UpdatedBeaconSetWithBeacons.handler(async ({ event, context }) => {

// Filter out the beacon set for the ETH/USD price

if (

event.params.beaconSetId !=

"0x3efb3990846102448c3ee2e47d22f1e5433cd45fa56901abe7ab3ffa054f70b5"

) {

return;

}

const entity: OraclePoolPrice = {

id: `${event.chainId}-${event.block.number}-${event.logIndex}`,

value: event.params.value,

timestamp: event.params.timestamp,

block: event.block.number,

};

latestOraclePrice = Number(event.params.value) / Number(10 ** 18);

context.OraclePoolPrice.set(entity);

});

UniswapV3Pool.Swap.handler(async ({ event, context }) => {

const entity: UniswapV3PoolPrice = {

id: `${event.chainId}-${event.block.number}-${event.logIndex}`,

sqrtPriceX96: event.params.sqrtPriceX96,

timestamp: event.block.timestamp,

block: event.block.number,

};

latestPoolPrice = Number(

BigInt(2 ** 192) /

(BigInt(event.params.sqrtPriceX96) * BigInt(event.params.sqrtPriceX96))

);

context.UniswapV3PoolPrice.set(entity);

});

UniswapV3Pool.Mint.handler(async ({ event, context }) => {

const offChainPrice = await fetchEthPriceFromUnix(event.block.timestamp);

const ethDepositedUsdPool =

(latestPoolPrice * Number(event.params.amount1)) / 10 ** 18;

const ethDepositedUsdOffchain =

(offChainPrice * Number(event.params.amount1)) / 10 ** 18;

const ethDepositedUsdOrcale =

(latestOraclePrice * Number(event.params.amount1)) / 10 ** 18;

const EthDeposited: EthDeposited = {

id: `${event.chainId}-${event.block.number}-${event.logIndex}`,

timestamp: event.block.timestamp,

block: event.block.number,

oraclePrice: round(latestOraclePrice),

poolPrice: round(latestPoolPrice),

offChainPrice: round(offChainPrice),

depositedPool: round(ethDepositedUsdPool),

depositedOffchain: round(ethDepositedUsdOffchain),

depositedOrcale: round(ethDepositedUsdOrcale),

offchainOracleDiff: round(

((ethDepositedUsdOffchain - ethDepositedUsdOrcale) /

ethDepositedUsdOffchain) *

100

),

txHash: event.transaction.hash,

};

context.EthDeposited.set(EthDeposited);

});

function round(value: number) {

return Math.round(value * 100) / 100;

}

Step 5: Run Your Indexer

Start your indexer with:

pnpm dev

This will begin indexing data from block 11,000,000 on Blast.

Step 6: Analyze the Results

After running your indexer, you can query the data in Hasura to compare the three price data sources:

query ComparePrices {

EthDeposited(order_by: { block: desc }, limit: 10) {

block

timestamp

oraclePrice

poolPrice

offChainPrice

depositedPool

depositedOffchain

depositedOrcale

offchainOracleDiff

txHash

}

}

Results Analysis

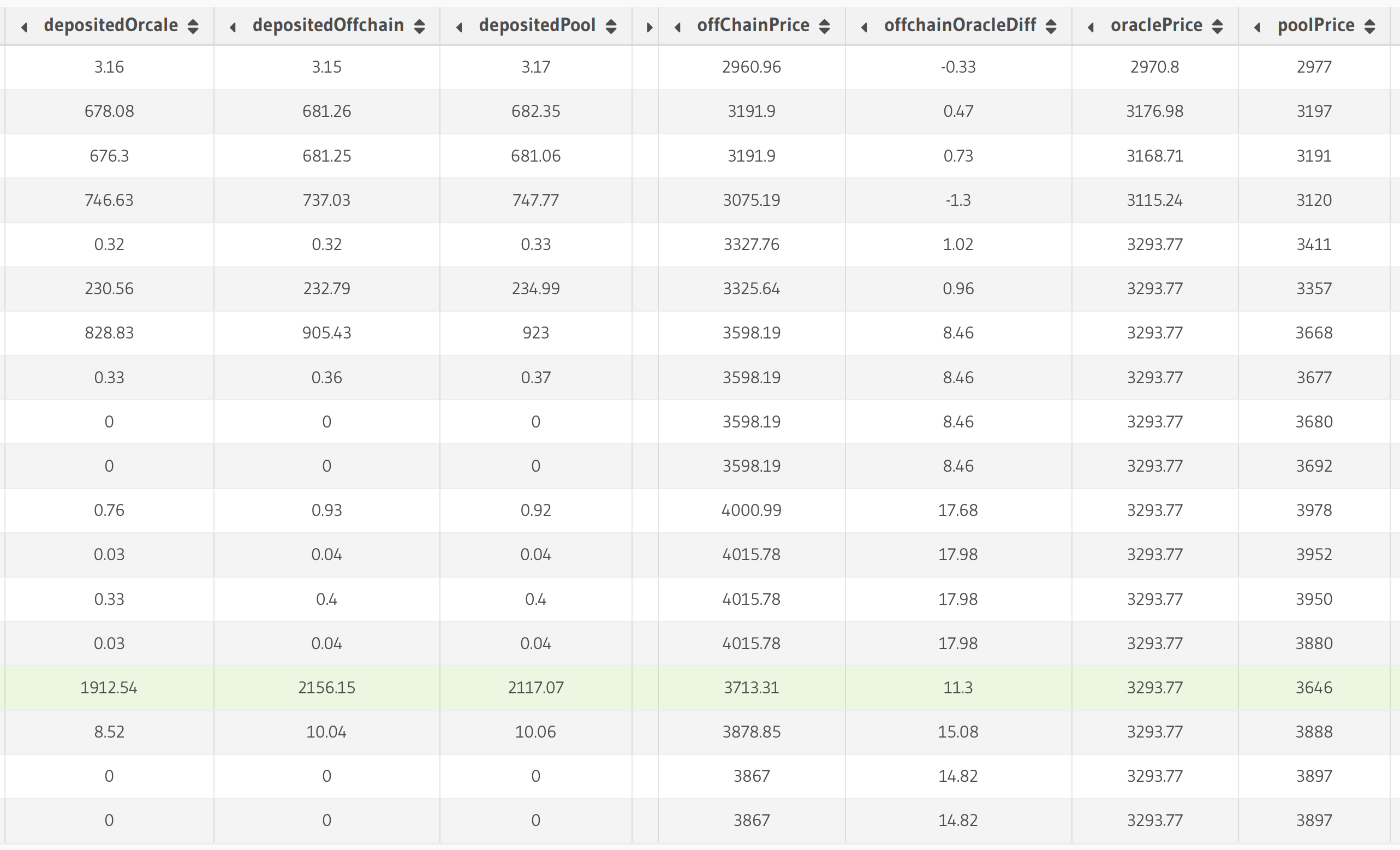

When comparing our three price data sources, we found:

Looking at the offchainOracleDiff column, we can see that oracle and off-chain prices typically align closely but can deviate by as much as 17.98% in some cases.

For the highlighted transaction (0xe7e79ddf29ed2f0ea8cb5bb4ffdab1ea23d0a3a0a57cacfa875f0d15768ba37d), we can compare our calculated values:

- Actual value (from block explorer): $2,358.27

- DEX pool value (

depositedPool): $2,117.07 - Off-chain API value (

depositedOffchain): $2,156.15

This demonstrates that even the most accurate methods have limitations.

Conclusion: Choosing the Right Method

Based on our analysis, here are some recommendations for choosing a price data method:

Use Oracle or DEX Pools when:

- Indexing speed is critical

- Absolute precision isn't required

- You're working with high-liquidity tokens

Use Off-chain APIs when:

- Price accuracy is paramount

- Indexing speed is less important

- You can implement effective caching

For maximum accuracy while maintaining performance:

- Combine multiple methods and aggregate results

- Use high-volume DEX pools on major networks

- Cache API results to avoid redundant calls

Next Steps

To further enhance your price data indexing:

- Implement caching for off-chain API calls

- Cross-reference multiple DEX pools for better accuracy

- Consider time-weighted average prices (TWAP) instead of spot prices

- Use multichain indexing to access higher-liquidity pools on major networks

By carefully choosing and implementing the right price data strategy, you can build robust indexers that provide accurate financial data for your blockchain applications.